The humanoid robotics sector is experiencing unprecedented growth, with 2024 marking the emergence of advanced prototypes, 2025 witnessing the beginning of mass production, and 2026 projected to usher in widespread commercial adoption.

Throughout 2024, industry leaders and innovative startups have made significant strides in humanoid robot development. Notable milestones include Boston Dynamics' release of an electric Atlas model (April 17), Unitree's introduction of the G1 humanoid robot priced from $16,000 (May 13), 1XTech's unveiling of the bipedal NEO (August 31), and Kepler's launch of the K2 (October 18). This surge of technological innovation from major manufacturers has injected vital momentum into the humanoid robotics industry.

As we move through 2025, the focus has shifted to mass production and comprehensive functionality testing. Tesla CEO Elon Musk has announced plans to produce 10,000 Optimus robots this year, with potential scaling to 10,000 units monthly by 2026 if development proceeds as anticipated.

This comprehensive guide explores multiple dimensions of the humanoid robotics landscape, including:

As perhaps the most exciting technological frontier of 2025, humanoid robotics represents a transformative field with far-reaching implications across multiple sectors.

A humanoid robot is a robot designed to resemble the human body in shape and function, typically featuring a torso, head, two arms, and two legs. Some robots include wheeled bases instead of legs, and maintain human-like upper bodies. These robots are engineered not only to mimic human physical appearance but also to replicate human movements, actions, and capabilities.

The primary purpose of humanoid design is functional: enabling robots to operate efficiently in environments built for humans without requiring significant modifications to existing infrastructure. This human-like form allows them to interact with tools, navigate spaces, and perform tasks originally designed for human execution, such as climbing stairs, opening doors, or manipulating objects.

Humanoid robots are equipped with sophisticated components including:

These robots are increasingly capable of performing complex tasks through artificial intelligence and machine learning, allowing them to adapt to unpredictable real-world scenarios after training in simulated environments. For example, Boston Dynamics' Atlas robots first master dynamic movements like parkour and backflips in physics-based simulation environments where they can safely fail thousands of times, then transfer this learning to physical robots that demonstrate remarkable adaptation when encountering real-world variations like uneven surfaces or unexpected obstacles.

Humanoid robots are distinguished from other robotic systems by their comprehensive integration of four essential capabilities:

These feature human-like legs and feet for walking and balancing, providing maximum mobility in human environments but requiring sophisticated balance systems.

Combining human-like upper bodies with wheeled bases, these offer increased stability and energy efficiency at the cost of stair navigation capabilities.

| Robot Type | Wheeled Humanoid Robots | Legged Humanoid Robots |

| Key Features | Wheel-driven propulsion combined with robotic arms and dexterous hand solutions. Emphasizes tactile sensors and dexterous manipulation capabilities while maintaining mobility. | Emphasizes the robot's leg mobility capabilities, with hands primarily used only for balance. |

| Representative Products | Agibot A2-W, Paxini, 1Xtech EVE, Jianzhouni TORO-ONE | Tianlink Robot T1, Leju Robotics, Unitree H1, Figure A1 |

Humanoid robot applications can be ranked by increasing demands on motion control capabilities:

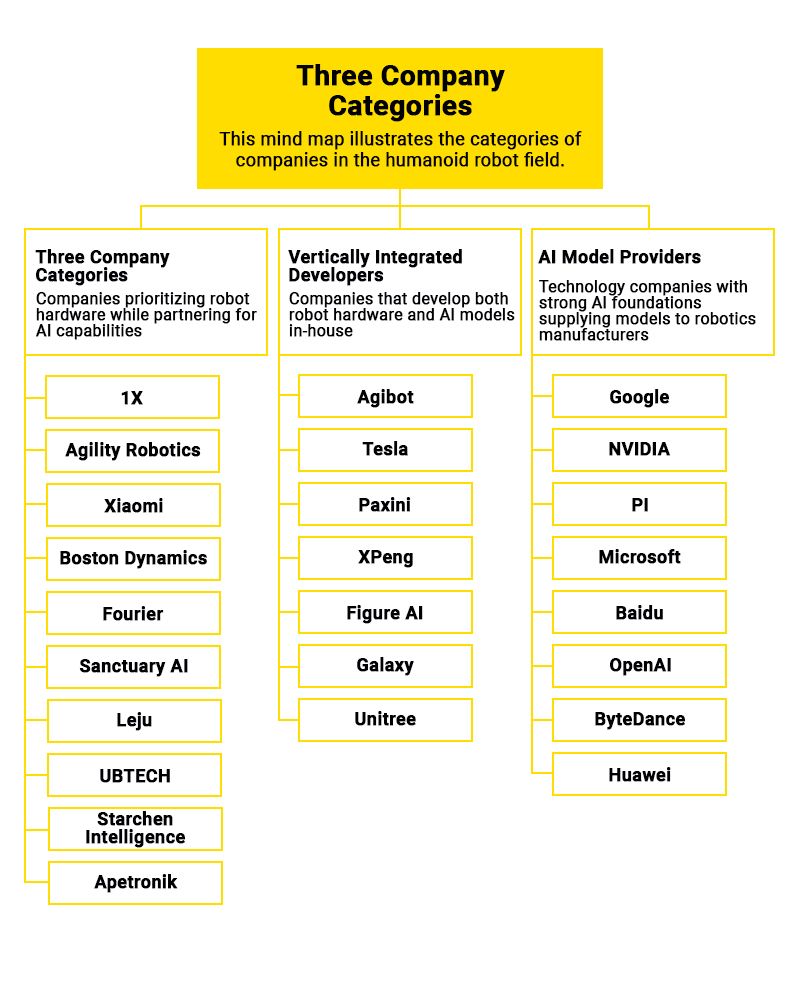

Companies that develop both robot hardware and AI models in-house.

Companies prioritizing robot hardware while partnering for AI capabilities.

Technology companies with strong AI foundations supplying models to robotics manufacturers.

This classification framework helps stakeholders understand the current landscape and evolutionary trajectory of humanoid robotics as the technology continues to mature.

The global humanoid robot market is experiencing exponential growth, with valuations reaching $2.37 billion in 2023 and projected to expand at a 40.69% CAGR through 2034. By 2033, the market is expected to reach $69.65–113.89 billion, driven by advancements in AI, labor shortages, and diverse industrial applications, according to Fortune Business Insights, 2025, and Market.us, 2025.

Similar to autonomous vehicles, humanoid robots follow a development progression through six distinct levels of autonomy and intelligence. The industry is currently in transition between L3 and L4 capabilities, with significant advancements expected in the coming years.

Definition: Basic mechanical systems with no independent function

Definition: Basic programmable movement with limited independent function

Definition: Algorithm-driven movement planning with specified parameters

Definition: Sensor-equipped systems with environmental awareness

Definition: Cognitive systems capable of independent reasoning and task completion

Definition: Human-equivalent general intelligence with creative problem-solving

Current Industry Position: The humanoid robotics sector is primarily operating between L2 and L3, with leading companies pushing into early L4 capabilities. This transition is characterized by increasing integration of large language models, improved sensory processing, and more sophisticated motion planning algorithms. The advancement from L3 to L4 represents a critical inflection point where robots begin shifting from executing predefined tasks to understanding and adapting to complex, changing environments.

The evolution of humanoid robotics has accelerated dramatically in the past fifteen years, building upon decades of earlier mechanical developments. While conceptual humanoid machines date back to the late 19th century with creations like Ali the Electrical Automaton in 1886, the modern era began with Honda's ASIMO in the early 2000s, culminating in its advanced 2011 version that featured the world's first autonomous behavior control technology. This version of ASIMO represented a significant leap forward in motion control, enabling balanced walking without operator control. The development of humanoid robots has been driven by a vision to create machines that can assist humans in various settings, from manufacturing to healthcare, addressing labor shortages and enhancing quality of life.

The period from 2012 to 2017 saw significant advancements in motion control and human interaction capabilities. In 2012, French company Aldebaran introduced Romeo, a humanoid robot designed specifically to assist elderly people with household tasks, capable of high-quality bipedal walking and complex behaviors like opening doors. By 2014, Softbank's Pepper emerged as a milestone in human-robot interaction, featuring the ability to recognize human emotions through facial expressions and voice tones. This was followed by Toyota's T-HR3 in 2017, which showcased remarkable mimicry capabilities through its Master Maneuvering System – a remote control setup that enabled the robot to mirror the movements of its human controller with precision. These developments represented steady progress toward creating robots that could not only navigate human environments but also interact meaningfully with people.

From 2018 to 2022, humanoid robots made extraordinary advances in mobility, perception, and AI integration. Boston Dynamics' Atlas demonstrated impressive agility in 2018 with its "dual-leg" standing body sensors and perception capabilities through RGB cameras and depth sensors, allowing it to navigate complex environments. In 2020, Agility Robotics introduced Digit, a commercially available bipedal robot priced at $250,000 that could jump, climb stairs, and work alongside autonomous vehicles for deliveries. Digit was specifically designed to operate in human environments without requiring modifications to existing infrastructure, making it ideal for warehouses and logistics operations. Tesla joined the humanoid robot race in 2022 with Optimus, leveraging the company's neural network technology developed for autonomous driving to create a general-purpose robotic assistant intended for tasks considered dangerous, repetitive, or boring for humans.

The most recent period (2023-2025) has witnessed rapid innovation and commercial deployment of humanoid robots. In 2023, Sweden's 1X unveiled NEO, featuring advanced AI capabilities that enable free movement and remote operation, with plans to test its Neo Gamma version in hundreds of homes by the end of 2025. In April 2024, Boston Dynamics released an all-electric version of Atlas with broader range of motion and higher dexterity than its hydraulic predecessor. Later that year, China's UBTECH introduced the Walker S1 humanoid robot, which demonstrated groundbreaking integration with unmanned logistics vehicles, driverless cars, and intelligent manufacturing systems. By 2025, humanoid robots have begun real-world deployment at scale, with Agility's Digit robots handling tasks in factories for customers like GXO Logistics, and UBTech's Walker S1 receiving over 500 orders from major manufacturers including BYD, the world's largest electric vehicle maker. This commercialization phase marks a pivotal transition from laboratory research to practical applications, addressing labor shortages and transforming industries through automation.

The following is the development of humanoid robot technology, according to the Prospect Industry Research Institute:

This development will be driven by several factors:

Based on comprehensive capabilities including AI model integration, commercialization potential, production readiness, customer adoption, and dexterity, we rank the Western humanoid robotics companies as follows (arbitrary ranking): Tesla > Figure AI > Agility > Apptronik > Sanctuary AI > Boston Dynamics > 1X > Neura Robotics > Mentee Robotics.

Comparison analysis of the western humanoid robot manufacturers

| Company | Tesla | Figure AI | Agility | Apptronik | Sanctuary AI | Boston Dynamics | 1X | Neura Robotics |

| Country | USA | USA | USA | USA | Canada | USA | Norway | Germany |

| Stage | Large corporation with a robotics division | Startup | Startup | Startup | Startup | Established | Startup | Startup |

| Commercial Applications | Automotive manufacturing | Automotive factories and logistics |

Logistics |

Automotive factories and logistics | Commercial retail | — | Household | Industrial/Home |

| Production Plans | Thousands in 2025, 10x annual growth in 2026-27 | 2 customers as of January, 2025, in the next 4 years (2025-28) production is forecasted to reach 100,000 - 200,000 units | Hundreds produced in 2024, targeting 10,000 annual units | Hundreds manufactured in 2025 | Mass production targets set in July 2024, but facing challenges (founder resigned) | Transitioning from hydraulic to electric | 1,000 units in 2025, tens of thousands of NEO by 2028 | 1 billion euros in orders |

| Key Customers | Internal use | BMW, Amazon | Amazon, GXO | Mercedes-Benz, GXO | CTC, Magna | — | Home users | Kawasaki Industries, European customers |

| Leg Configuration | Bipedal | Bipedal | Ostrich-style bipedal | Bipedal/Wheeled | Bipedal (with wheeled option) | Bipedal | Upgraded to bipedal | Bipedal |

| Hand Capabilities | 22 degrees of freedom | 16 degrees of freedom | Electric gripper | — | 20 degrees of freedom | Three-finger gripper | 20 degrees of freedom | Modular hands/Claws |

| AI Model Integration | Self-developed | OpenAI partnership/NVIDIA Cosmos | NVIDIA Cosmos | Google partnership/NVIDIA Cosmos | Self-developed/NVIDIA Cosmos | NVIDIA Cosmos | OpenAI partnership/NVIDIA Cosmos | NVIDIA Cosmos |

Tesla has established itself as the dominant force in humanoid robotics through its comprehensive vertical integration of hardware and software. The company's Full Self-Driving (FSD) technology provides the foundation for physical intelligence capabilities that are currently unmatched in the industry.

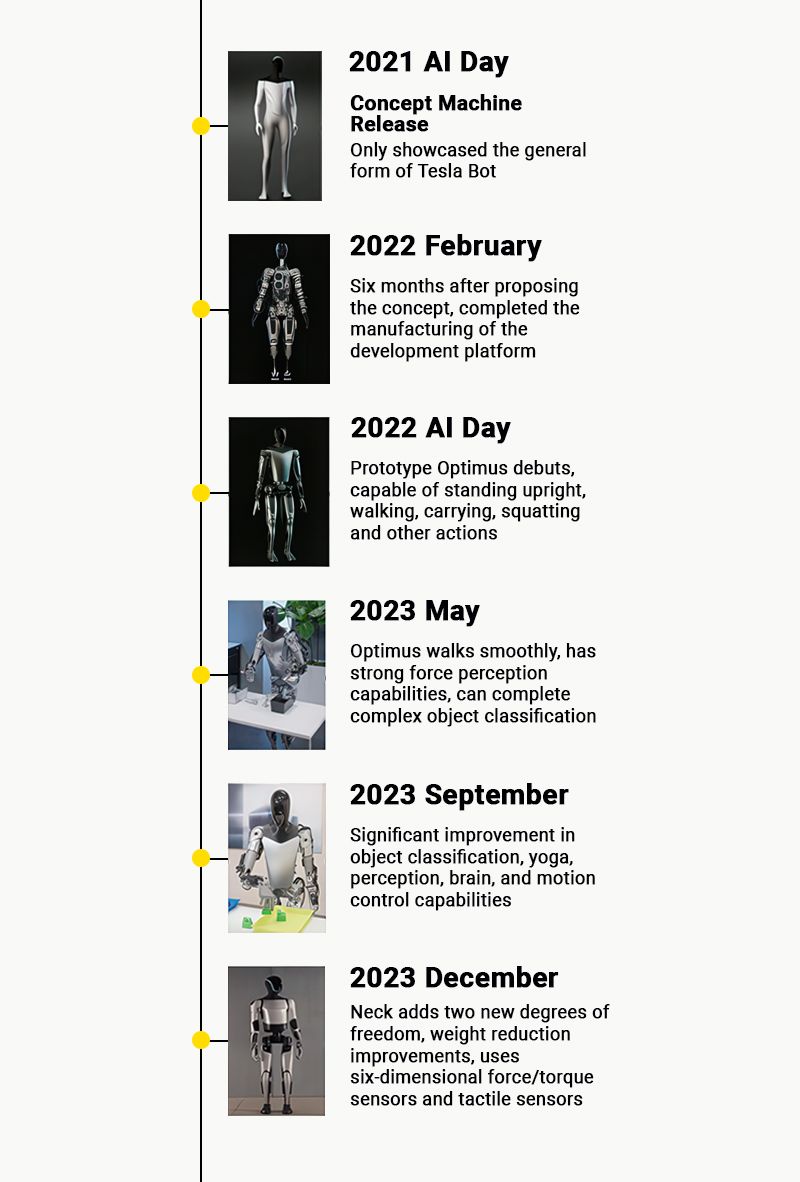

Tesla's Optimus robot has undergone significant evolution since its initial introduction in August 2021. The latest generation Optimus Gen2 features dramatically improved mobility with a natural, human-like walking gait characterized by straight knees, heel-to-toe movement, and natural arm swing. These improvements were achieved through reinforcement learning techniques rather than hard-coded movements, allowing the robot to develop more natural movements through AI training.

In February 2025, Tesla posted multiple engineering positions at its Fremont factory, signaling an acceleration of its mass production plans for humanoid robots. With its comprehensive technological foundation and manufacturing capabilities, Tesla has positioned itself to potentially transform both industrial and consumer robotics applications.

Figure AI, founded in late 2022 and headquartered in Sunnyvale, California, has quickly established itself as a frontrunner in the humanoid robotics industry. The company has secured substantial backing from technology giants including NVIDIA, OpenAI, and Microsoft, propelling its rapid development and commercial deployment.

Figure 01 was unveiled in March 2023 as the company's first-generation humanoid robot. The initial model demonstrated basic mobility and object manipulation capabilities but had exposed wiring and electronics designed for easy testing and modifications.

Figure 02, released in August 2024, represents a significant advancement with:

In March 2024, Figure AI secured a landmark $675 million Series B funding round that valued the company at $2.6 billion. Key investors included:

The funding accelerated Figure's timeline for commercial deployment of its humanoid robots. Initially, Figure collaborated closely with OpenAI to develop AI capabilities for its robots. However, on April 2, 2025, Figure announced it was terminating this partnership in favor of its self-developed VLA model called Helix.

The Helix VLA (Vision-Language-Action) model represents a breakthrough in robotics AI, enabling Figure's robots to:

This integration allows users to give simple verbal instructions like "Give me the apple on the table," and the robot can identify the apple, navigate to it, pick it up, and deliver it to the person. In February 2025, Figure demonstrated Helix running on a pair of Figure 02 robots cooperatively putting away groceries after receiving a single verbal instruction.

Figure achieved its first commercial deployment through a partnership with BMW, announced in January 2024. Under this agreement:

Figure secured a second commercial customer in late January 2025, expanding its market presence. The company plans to develop Figure 03 with a focus on mass production capabilities. At high production volumes, Figure aims to reduce the unit cost to under $20,000 per robot from the current target price of approximately $50,000.

Agility Robotics, founded in 2015 as a spinoff from Oregon State University, has developed one of the most commercially successful humanoid robots on the market. Their flagship product, Digit, features a distinctive design that has earned it industrial applications ahead of many competitors.

Digit stands 5 feet 9 inches (175 cm) tall with a distinctive teal and metallic gray exterior. Its most notable design feature is the unique "ostrich-like" leg configuration - a reverse-jointed bipedal structure that differs significantly from most humanoid robots. This specialized leg design enables:

The robot is equipped with an advanced sensor array including:

Digit's end effectors are designed for versatile grasping capabilities, allowing it to handle payloads up to 35 pounds (15.9 kg). Recent upgrades have expanded its manipulation abilities with improved limbs and end effectors that provide wider grasping angles.

The latest generation of Digit (announced in April 2025) features significant performance improvements:

Agility has pioneered commercial applications for humanoid robots with several significant milestones:

Agility's $150 million manufacturing facility in Salem, Oregon, established in 2023, is designed to ultimately produce more than 10,000 robots annually. This positions the company to meet growing demand as more companies integrate humanoid robots into their operations.

Agility Robotics has secured substantial funding to scale its operations. In April 2025, the company reportedly raised $400 million in a funding round led by WP Global's venture arm, with participation from SoftBank. This investment values the company at approximately $1.75 billion and follows previous funding of $150 million in 2022 led by DCVC and Playground Global with Amazon's Industrial Innovation Fund participating.

Apptronik, founded in 2016 and headquartered in Austin, Texas, has emerged as a leading developer of humanoid robots. The company originated from the Human Centered Robotics Lab at the University of Texas at Austin and has established significant partnerships with both government agencies and commercial enterprises.

Apollo, Apptronik's flagship humanoid robot unveiled in August 2023, stands 5 feet 8 inches (1.73 meters) tall and weighs approximately 160 pounds (72.6 kg). The robot features:

These specifications enable Apollo to work effectively in human-centric environments without requiring significant infrastructure modifications.

Apptronik's relationship with NASA extends back to 2013, when the company's founders participated in the DARPA Robotics Challenge and were selected to work on NASA's Valkyrie robot. This collaboration provided critical expertise that informed Apollo's development. NASA has continued this partnership to advance humanoid robotics for potential space applications, including:

NASA contributed specific expertise in developing mobility features and software that ensure safe operation when working alongside humans. The agency's interest in Apollo stems from its potential adaptability for space missions.

Apollo is designed as a general-purpose robot capable of performing various tasks across multiple industries. Its applications include:

Apptronik has secured several high-profile commercial partnerships:

In February 2025, Apptronik raised $350 million in Series A funding, establishing a new record for humanoid robotics industry financing. This funding round was:

With this substantial financial backing, Apptronik is positioning Apollo as a versatile solution that can transform multiple industries through its adaptability and intelligence. The company's founders describe Apollo as "one of the most advanced tools humanity has ever created," with applications that will continue to evolve as the platform matures.

Sanctuary AI, founded in 2018 and headquartered in Vancouver, Canada, has secured over $140 million in funding from investors including BDC Capital and InBC Funds. The company has focused on developing highly dexterous robots with advanced AI capabilities, culminating in their flagship Phoenix robot which reached its eighth generation in December 2024.

Design Philosophy Shift: Sanctuary AI has made a strategic pivot in their robot design approach. While the seventh generation Phoenix featured bipedal locomotion, the eighth generation model adopts a wheeled mobility system. This design choice prioritizes:

Advanced Manipulation: Phoenix's most impressive technical achievement is its highly articulated hand system:

Phoenix is powered by Sanctuary's proprietary Carbon AI system, designed to provide human-like intelligence and generalization capabilities. This cognitive architecture enables:

Sanctuary has established strategic partnerships with technology leaders:

These collaborations are instrumental in developing Sanctuary's Large Behavioral Models, which aim to translate generalized intelligence into physical actions in the real world.

Sanctuary AI has made significant progress in practical applications:

These commercial implementations demonstrate the robot's readiness for real-world applications and provide valuable data for further refinement of both hardware and AI systems.

Boston Dynamics, founded in 1992 by a team with Massachusetts Institute of Technology backgrounds, stands as the oldest active humanoid robotics company. For over three decades, the company has focused on developing exceptional motion control technologies that have set industry standards for robotic movement capabilities.

Boston Dynamics' journey in robotics development follows a progressive evolution:

The transition to an all-electric Atlas represents a significant technological shift, offering enhanced power efficiency, improved range of motion, and greater potential for commercial applications. This new generation maintains the exceptional mobility that Atlas is known for while addressing limitations of the hydraulic system.

Atlas has distinguished itself through superior balance control and dynamic motion performance. These capabilities stem from Boston Dynamics' deep expertise in:

These technical foundations enable Atlas to navigate complex terrain and perform intricate maneuvers while maintaining stability—capabilities that have been showcased in numerous viral videos demonstrating the robot's increasingly human-like movement patterns.

Boston Dynamics has undergone several ownership changes throughout its history:

Under Hyundai's ownership, Boston Dynamics has accelerated commercialization efforts, with plans to deploy Atlas robots in Hyundai manufacturing facilities by late 2025. The company has also formed strategic partnerships to enhance its technological capabilities:

1X Technologies, founded in Norway in 2014 (originally named Halodi Robotics), has developed an impressive lineup of robotic platforms. The company draws talent from leading AI research organizations including Google Brain and DeepMind, providing a strong foundation in artificial intelligence and machine learning.

1X offers two distinct robotic platforms:

EVE: The company's first-generation robot features a wheeled mobility system and is designed for commercial applications including:

NEO Beta: Introduced in August 2024, this second-generation platform represents 1X's entry into full humanoid robotics. NEO Beta is specifically designed for home service applications and has gained significant attention for its remarkably natural movement patterns.

NEO Beta incorporates several advanced technologies that enable its fluid, human-like motion:

These technical capabilities allow NEO Beta to achieve movements that appear notably more natural and less mechanical than many competing platforms, particularly in upper-body articulation and transitional movements.

1X has secured substantial financial backing and technical partnerships:

While 1X has incorporated OpenAI's technology, the company has not yet implemented the most recent GPT-4 level capabilities that have been deployed by some competitors like Figure AI.

1X has begun commercial deployment of its robotics platforms:

The company's focus on creating robots for home environments distinguishes it from many competitors who are primarily targeting industrial and commercial applications, reflecting 1X's belief in the potential for humanoid robots to become mainstream household devices.

Neura Robotics, founded in 2019 by David Reger, stands as Germany's leading humanoid robotics company. The company has secured significant financial backing with nearly $130 million in funding and boasts an impressive order book worth nearly $1 billion. Headquartered in Metzingen, Germany, Neura has rapidly established itself as a pioneer in cognitive robotics with over 200 employees.

The 4NE-1 humanoid robot features impressive physical specifications:

What distinguishes 4NE-1 is its advanced cognitive capabilities and multimodal perception systems:

4NE-1 employs a sophisticated three-tier cognitive framework that mirrors human cognitive processes:

This layered intelligence allows the robot to understand its surroundings, respond to human gestures and voices, and make intelligent decisions. The system learns from experience and can recognize human emotions.

In July 2024, Neura Robotics announced it was joining NVIDIA's Humanoid Robot Developer Program. This partnership gives Neura access to:

The company has integrated these technologies with its own Neuraverse platform to speed up development and deployment of both cognitive and humanoid robots.

Neura Robotics aims to deliver up to 5 million humanoid and cognitive robots worldwide by 2030. The company's product portfolio includes:

The third-generation 4NE-1 is scheduled for launch in June 2025, with CEO David Reger confidently claiming it will be "the best robot on the market". In promotional videos, the robot has been shown performing various activities like ironing and moving boxes, demonstrating its versatility for both household and industrial applications.

Neura Robotics is positioned as the clear leader in Germany's humanoid robotics sector, with its 4NE-1 closer to mass deployment than other German humanoid robots, which are primarily being developed for research purposes.

Mentee Robotics, founded in late 2021 in Israel, is developing an advanced humanoid robot under the leadership of Amnon Shashua, who is also the founder of Mobileye—the world's largest supplier of advanced driver assistance systems (ADAS). This connection provides the company with significant expertise in computer vision and AI technologies that directly benefit their robotics development.

MenteeBot integrates AI across all operational layers with particular strengths in two key areas:

Advanced Perception and Movement:

Communication and Interaction:

The recently unveiled MenteeBot V3.0 (February 2025) represents a significant advancement with several notable hardware features:

These specifications enable the robot to function effectively in both complex industrial environments and everyday household scenarios without performance degradation.

Mentee Robotics has established a clear product development strategy:

The company's development approach leverages their team's deep expertise in generative AI and computer vision, with all AI models developed in-house rather than relying on third-party solutions. This integrated development strategy allows for tighter coordination between hardware capabilities and software intelligence.

Tesla has established itself as the clear leader in humanoid robotics through its comprehensive vertical integration approach. The company has built a complete technology stack that includes:

This full-stack development approach gives Tesla unmatched control over every aspect of its robotics program, from hardware design to AI implementation.

In December 2023, Tesla unveiled the second generation of its humanoid robot, Optimus Gen2. This advanced robot demonstrates remarkable precision, capable of handling delicate objects like eggs with accuracy. Key features include:

The October 2024 "We, Robot" launch event showcased these capabilities with live demonstrations of the robot's advanced manipulation skills.

Tesla has established an ambitious production schedule for its humanoid robots:

NVIDIA leads the humanoid robotics industry through its powerful computational capabilities and comprehensive data training platforms. The company provides critical infrastructure including:

By building this underlying development ecosystem, NVIDIA has become the foundation for most of the humanoid robotics companies operating today.

NVIDIA's humanoid robotics technology stack includes:

NVIDIA has fostered partnerships with leading robotics developers worldwide, providing them with the computational foundation for next-generation humanoid robots:

The company's approach is centered on Google DeepMind, which has created a specialized family of AI models called Gemini Robotics specifically designed for controlling physical robots. These models, introduced in March 2025, represent a significant advancement in robotics AI by combining vision processing, language understanding, and physical action capabilities. The system excels at complex tasks requiring fine motor skills, enabling robots to perform activities like folding origami, preparing meals, packing lunch boxes, and even playing games like Tic-Tac-Toe.

In December 2024, Google DeepMind formed a strategic partnership with Apptronik, a Texas-based humanoid robotics company, to integrate Google's advanced AI systems with Apptronik's Apollo robot platform. Beyond Apptronik, Google is expanding its robotics ecosystem by working with additional partners including Agile Robots, Agility Robotics, Boston Dynamics, and Enchanted Tools as "trusted testers" for its Gemini Robotics-ER technology.

After stepping back from robotics in 2020 due to technical limitations in simulating real-world physics and data constraints, OpenAI returned to the field in 2025. Unlike Tesla, NVIDIA, and Google, so far OpenAI primary contribution to humanoid robotics has been through strategic investments and partnerships rather than developing its own technology.

The company has:

Microsoft's humanoid robotics strategy includes:

Amazon concentrates on practical deployment for logistics:

These companies are taking more focused approaches:

Apple:

Meta:

Based on our evaluation of technical specifications, degrees of freedom, motion control capabilities, AI model integration, brand recognition, application scenarios, and commercialization progress, the current ranking of Chinese robotics manufacturers is as follows.

UBTECH Robotics, founded in 2012, became China's first publicly traded humanoid robotics company following its Hong Kong stock market listing in late 2023. Despite facing internal management challenges and reporting losses exceeding revenue, the company maintains its position as China's pioneer in large-scale commercialization of humanoid robots.

The company's product evolution reflects its progressive technological advancement. UBTECH initially focused on smaller educational robots, launching the panda-shaped Alpha learning robot in 2014 for the AI education market. The company gained national recognition in 2016 when 540 Alpha 1S robots performed synchronized dances during the CCTV Spring Festival Gala. In 2018, UBTECH unveiled its first-generation Walker humanoid robot, which has undergone continuous iteration and refinement. The company's current product lineup includes three major humanoid platforms: Walker, Walker X, and the Panda Robot YoYo, serving diverse sectors including education, logistics, entertainment, and business services.

UBTECH has established robust intellectual property foundations with over 2,100 patents covering its full-stack technology approach. This comprehensive technological ecosystem integrates hardware, software, services, and content in a unified platform. The Walker series features more than 40 degrees of freedom throughout its body and achieves remarkable bipedal movement precision with gait control error less than 2cm. The robots' motion control system employs proprietary 3D visual positioning combined with multi-sensor fusion to enable complex movements including dynamic balancing, stair navigation, and dance performances.

The company's AI capabilities center on its proprietary "Cloud AI" multimodal interaction system, which integrates custom-developed speech and vision models supporting contextual task learning. In February 2025, UBTECH announced a partnership with DeepSeek to develop advanced multimodal embodied reasoning models specifically designed for humanoid robots. This collaboration builds on earlier integration with Baidu's Wenxin large language model, which enhanced the Walker S platform's multimodal perception, intent understanding, and task planning capabilities.

UBTECH leads China's humanoid robot commercialization efforts with extensive industry partnerships. The Walker S1 has been adopted by major manufacturers including BYD, Geely, Foxconn, Dongfeng Liuqi, FAW Hongqi, and SF Express for practical training programs. By early 2025, the company had secured orders exceeding 500 units from automotive manufacturers alone. UBTECH's strategic roadmap targets breakthrough applications in 3-5 key industries within the next three to five years, with plans to achieve mass production capabilities through 18-24 months of production line optimization. The company projects cumulative shipments exceeding 20,000 units by the end of 2025, supporting a corporate valuation exceeding $10 billion.

Unitree Robotics, founded in 2016 by Wang Xingxing (born in the 1990s), has rapidly established itself as a leading force in China's robotics industry. In just eight years, the company has achieved unicorn status with a current valuation of $8 billion. Unitree's technological innovations and market impact have garnered high-level government recognition, with Wang being personally acknowledged by China's General Secretary during a February 2025 forum for private enterprises at the Great Hall of the People, who noted, "You are the youngest entrepreneur here!"

Unitree distinguishes itself through vertical integration, independently developing critical components including motors, gearboxes, controllers, LiDAR systems, and binocular cameras. This self-reliance in core technologies enables greater control over performance and quality while reducing dependency on international supply chains. The company's three-finger dexterous hand system, Dex3-1, represents a significant advancement in robotic manipulation capabilities. Unitree's robotics platform is powered by their proprietary UnifoLM world model, while the company strategically partners with NVIDIA to leverage advanced general-purpose AI for enhanced robot functionality.

The company's product portfolio reflects its progressive technical evolution. Unitree initially established market dominance with its industrial-grade quadruped robots—the B1 and B2 models launched in fiscal years 2022 and 2023 respectively—which now command approximately 60% of global market share in their category. Building on this success, Unitree expanded into humanoid robotics with the H1 model introduced in August 2023, followed by the enhanced G1 version in May 2024. With pricing starting at $16,000, Unitree offers among the most competitive entry points for advanced humanoid robots, positioning the company to potentially lead mass-market adoption as production scales and costs decrease further.

Zhiyuan Robotics (also known as Agibot) was founded in February 2023 by two notable tech figures: Zhihui Jun, a former Huawei "genius boy" who specialized in AI edge computing as part of Huawei's Rise computing product line, and Professor Yan Weixin from Shanghai Jiaotong University. Despite being established just over two years ago, the company has demonstrated remarkable growth, completing eight financing rounds with a current valuation exceeding 7 billion yuan (approximately $1 billion). Their impressive investor roster includes Gao Tiles Venture Capital, automotive giant BYD, and Blue Chip Ventures.

Zhiyuan has adopted a comprehensive full-stack development approach, building all critical components including software, hardware, AI "brain," motion control "cerebellum," and cloud systems entirely in-house. Rather than relying on OEM assembly, the company established its own manufacturing facility in Shanghai's Lingang area, giving it complete control over production quality and capacity.

Six months after founding, Agibot unveiled its first humanoid robot, the Expedition A1. Standing 175cm tall with an 80kg payload capacity and 49 degrees of freedom, it immediately positioned itself among the most advanced humanoid robots developed in China. In August 2024, the company expanded its product line with five new models, including the Expedition series and the Rhinoceros X1, which features a full-stack open-source architecture allowing third-party developers to build upon its platform.

January 2025 marked another significant milestone with the introduction of EnerVerse, described as the world's first 4D world model. This advanced AI system guides robots through complex tasks while generating future embodied space through autoregressive diffusion modeling. Agibot has also established a five-generation roadmap for embodied intelligence evolution: G1 (specific scenario focus), G2 (multi-scenario capabilities with limited generalization), G3 (transition from algorithm-driven to data-driven approaches), G4 (incorporation of simulation data and world models), and G5 (high-level autonomy from sensing to execution). Currently, the company positions its technology between the G2 and G3 stages.

Zhiyuan has formed strategic partnerships with JunPu Intelligence, Digital Huaxia, KDDI, Nortel Digital Intelligence, and iSoftStone to develop commercially viable applications across various sectors. As of January 2025, the company had produced over 1,000 general-purpose robots, demonstrating both manufacturing capacity and market acceptance.

Fourier Intelligence, founded in 2015 by Gu Jie, began with a specialized focus on medical rehabilitation robotics before expanding into general-purpose humanoid robots. Named after the renowned mathematician Jean-Baptiste Joseph Fourier, the company established its initial reputation by developing therapeutic devices, launching upper limb rehabilitation robots in 2016 followed by lower limb rehabilitation systems in 2017.

The company's technological trajectory changed significantly in 2019 when its breakthrough development of frameless motors enabled the establishment of a dedicated humanoid robotics program. This innovation culminated in the 2023 release of GR-1, Fourier's first general-purpose humanoid robot, marking the company's successful transition from medical rehabilitation devices to advanced humanoid systems. In September 2024, Fourier unveiled the next-generation GR-2, completing its comprehensive product ecosystem that integrates rehabilitation robots, the Galileo control system, and humanoid robots.

Fourier's technical advantage stems from its proprietary high-performance actuator technology. The FSA (Fourier Smart Actuator) integrates motor, driver, reducer, and encoder components into a unified system, enabling GR-1's exceptional motion flexibility and control precision. The more advanced GR-2 features 53 degrees of freedom throughout its body, with particular emphasis on its next-generation dexterous hands. These hands incorporate 12 degrees of freedom per hand and utilize the upgraded FSA 2.0 actuator system to deliver enhanced manipulation capabilities.

The company has successfully begun commercial deployment of its humanoid robots across diverse sectors. GR-1 units are currently undergoing operational training at China Construction Bank facilities and testing in SAIC-GM manufacturing plants. Leveraging its extensive background in medical devices, Fourier has also deployed robots as rehabilitation assistants in healthcare settings. By the end of 2024, Fourier had delivered more than 100 GR-1 units to customers. Industry projections suggest total humanoid robot deliveries across all manufacturers could exceed 1,000 units in 2025, with Fourier positioned as a significant contributor to this expanding market.

PaXini Technology has established itself as an innovative leader in tactile sensing technologies for robotics, developing a comprehensive product ecosystem spanning multi-dimensional tactile sensors, advanced dexterous hands, and sophisticated humanoid robots. The company specializes in high-precision tactile perception systems that significantly enhance robotic manipulation capabilities across industrial and service applications. In fact, western companies such as FigureAI purchase the dexterous hands from PaXini for their humanoids.

PaXini's multi-modal approach addresses critical limitations in robotic perception. While visual systems struggle with challenges like poor lighting, occlusion, and perspective distortion, tactile sensors provide immediate and accurate feedback about contact forces and states between robots and objects. This enables real-time adjustments to grasping force, posture, and hand trajectories—particularly valuable when handling soft, fragile, or irregularly shaped items.

Booster Robotics stands as a world-renowned humanoid robotics company with over 20 years of expertise in the field. Founded by Hao Cheng, a Tsinghua University graduate with extensive RoboCup competition experience, the company has built its reputation on creating accessible and practical humanoid platforms. In January 2025, Booster formed a strategic partnership with the RoboCup Federation alongside Fourier Intelligence and Unitree Robotics, demonstrating its commitment to advancing humanoid robotics research and education globally.

The company's flagship product, the Booster T1, is a versatile 118cm tall, 30kg open-source humanoid robot featuring 23 degrees of freedom. Priced between $20,000-$30,000, the T1 represents a significantly more affordable alternative to comparable humanoid platforms while maintaining impressive performance capabilities. The robot combines powerful hardware including an Intel i7 processor and NVIDIA AGX Orin chip delivering 200 TOPs of AI performance with a Realsense D455 RGBD camera and microphone array. It achieves walking speeds of 3.5 km/h, can perform complex movements like push-ups, kung-fu maneuvers, and boxing combinations, and smoothly transitions from lying down to standing positions.

Designed specifically for developers and researchers, the T1 provides a comprehensive development ecosystem featuring a complete API, ROS2 compatibility, and support for multiple simulation environments including Isaac Sim, Mujoco, and Webots. The robot's open architecture enables secondary development and customization, with Bluetooth connectivity to mobile apps for real-time control and feedback. These features make the T1 particularly valuable for educational institutions, research laboratories, and robotics enthusiasts seeking to experiment with advanced humanoid capabilities without the extreme costs associated with larger industrial platforms.

Booster Robotics' vision centers on uniting global developers to drive productivity evolution through accessible humanoid robotics. The company has secured substantial investment to scale production and expand market reach, focusing on providing stable, user-friendly humanoid platforms and efficient development tools that accelerate embodied AI implementation. Through its participation in initiatives like RoboCup, Booster contributes to the ambitious goal of creating fully autonomous humanoid robot soccer players capable of defeating human World Cup champions by 2050, while simultaneously advancing practical applications of humanoid technology across industrial, commercial, and research domains.

Galaxy, founded in May 2023 by Dr. Wang He (a Peking University doctoral graduate born in 1992), has quickly established itself as a formidable player in China's humanoid robotics sector. Within its first year of operation, the company secured 1.2 billion yuan ($150 mln USD) in financing, earning it the distinction of being China's humanoid robotics "financing champion" for 2024 and achieving super-unicorn status at an unusually early stage.

In June 2024, Galaxy General unveiled its first-generation humanoid robot, Galbot G1, at NVIDIA's CES 2025 event. This model represents the company's initial approach to embodied AI with a distinctive hybrid design featuring "two arms + one leg + wheeled chassis" configuration. This architecture was strategically chosen to balance cost control with performance reliability, with plans to evolve toward fully bipedal models in future iterations.

Galaxy General has developed sophisticated technical capabilities through vertical integration of hardware and software systems. To address the challenging "sim-to-real gap" (the discrepancy between simulation performance and real-world operation), the company created a proprietary depth sensor simulator that improves environmental perception. On the software side, Galaxy General developed Open6DOR, described as the first large model system supporting six degrees of freedom for object manipulation with open semantic commands. This innovation is complemented by additional specialized models including NaVid (video-based perception), GraspVLA (visual-language-action integration), and SAGE (general intelligence framework).

The company has already achieved commercial deployment milestones. In September 2024, Galbot G1 units demonstrated 24-hour unattended operation at Meituan Buy Drugs facilities, successfully completing inventory replenishment and item retrieval tasks. Galaxy General has also established partnerships with automotive manufacturers including Mercedes-Benz and Extreme Krypton, where its robots autonomously handle sunroof component transfers, depalletization operations, and material transport while incorporating real-time error detection and correction. These implementations have measurably improved production and assembly efficiency in manufacturing environments.

Leju Robotics, established in 2016 and originating from the Harbin Institute of Technology's robotics team, has evolved from creating educational robot toys to developing advanced full-scale humanoid robots. The company has built an impressive product portfolio including the KUAVO humanoid robot series, Aelos robots for education, and specialized solutions for logistics and healthcare. This progression demonstrates Leju's commitment to pushing the boundaries of humanoid robotics technology while maintaining their educational roots.

In 2024, Leju achieved a significant technological milestone when their flagship KUAVO humanoid robot was integrated with Huawei's advanced Pangu embodied intelligence large model. This integration, debuted at Huawei Developer Conference 2024, dramatically enhanced the robot's capabilities in natural language processing, environmental understanding, and task execution. The partnership culminated in March 2025 with the joint unveiling of the world's first 5G-Advanced equipped humanoid robot at Mobile World Congress 2025, featuring ultra-low latency and precise location tracking capabilities without additional equipment.

Leju has strategically positioned itself within China's robotics ecosystem through partnerships with industry leaders across multiple sectors. The company has established collaborative relationships with Huawei Cloud for AI development, China Mobile for telecommunications applications, Haier for smart home integration, and Jiangsu Hengtong for industrial manufacturing implementations. These partnerships enable Leju to deploy their humanoid robots across diverse scenarios including public service, healthcare, education, and manufacturing environments.

The company's KUAVO humanoid robot demonstrates impressive technical capabilities including bimanual coordination for complex manipulation tasks, advanced natural language processing for human-like conversation, and adaptive learning to personalize interactions. Leju has expanded its market presence through strategic deployments, including KUAVO robots serving as tour guides at China Mobile's Smart Home Operations Center and exploring applications with NIO in the automotive sector. Through continuous innovation and strategic partnerships, Leju has positioned itself as a frontrunner in China's rapidly expanding humanoid robotics industry, contributing to the nation's goal of mass-producing humanoid robots by 2025.

CloudMinds (also known as Daxu Technology) was founded in December 2015 by Huang Xiaoqing, former director of the China Mobile Research Institute. The company made its first major public appearance in 2023 with the unveiling of its humanoid bipedal robot XR4, nicknamed "Xiao Zi" (Little Purple). By early 2024, industry reports indicated the company was preparing for a Hong Kong IPO, cementing its position as a leader in China's intelligent robotics sector.

CloudMinds distinguishes itself through its proprietary "HARIX" cloud robotics architecture. This innovative approach combines three key elements: cloud-based AI processing ("cloud brain"), secure network infrastructure, and physical robot hardware. The company's guiding philosophy—"robots serve people, and Daxu serves robots"—reflects its vision of creating robotic assistants for widespread consumer adoption. This approach allows for lighter, more affordable robots by offloading complex processing to cloud servers.

The company has built an impressive intellectual property portfolio with more than 2,000 patent applications, giving it the world's largest collection of cloud robotics patents. CloudMinds' product ecosystem includes the RobotGPT model (which earned recognition as "the most internationally breakthrough Chinese brand"), the HARIX OS 5.0 cloud robot operating system, the Cloud Ginger 2.0 humanoid robot, and the SCA 2.0 intelligent flexible actuator system for precise movement control.

From a technical perspective, the Ginger robot features 32 degrees of freedom throughout its body, enabling human-like movement capabilities. The cloud-based brain architecture achieves millisecond-level response times while handling over 90% of decision-making processes in the cloud rather than on the robot itself. This architecture enables advanced capabilities including adaptive walking on variable terrain and coordinated dual-arm manipulation tasks that would require substantially more onboard computing power in traditional robot designs.

CloudMinds has focused its commercialization efforts on healthcare applications, smart city infrastructure, and elderly care services. The company plans to deploy more than 5,000 robots by 2025, with particular success in the elder care sector where it has secured 68% of robot orders from China's national elderly care institutions. CloudMinds has also established a strategic partnership with China Mobile to develop a robot cloud platform that processes an average of 20 petabytes of data daily—a scale that has earned it the nickname "the Amazon cloud of robotics."

Founded in October 2023, Shenzhen-based EngineAI has quickly established itself as a promising newcomer in humanoid robotics. The company debuted at CES 2025 with three models: the SE01, SA01, and PM01, designed as development platforms for advancing embodied intelligence. Led by industry veteran Zhao Tongyang, who previously founded Dogotix and XPENG Robotics, EngineAI employs 36 researchers from prestigious institutions including UC Berkeley. Their SE01 humanoid stands out for its remarkably human-like gait achieved through NVIDIA's Isaac Gym simulation environment, enabling the robot to perform complex movements including squatting, running, and push-ups. While ambitious, the company aims to produce over 1,000 units by year-end 2025 but remains primarily focused on research and development rather than immediate commercial deployment.

Robot Era, established in August 2023 and incubated by Tsinghua University's Institute for Interdisciplinary Information Sciences, secured nearly 300 million yuan in pre-Series A funding in October 2024. The company focuses on developing native general-purpose embodied intelligence systems with an innovative AI-driven hardware platform. Their flagship humanoid, STAR 1, represents a significant technological achievement with its end-to-end learning method that relies solely on neural networks for mobility and manipulation tasks. The robot features 55 degrees of freedom, improved joint torque of 400 N·m, and operating speeds up to 25 rad/s. While STAR 1 has passed multiple product-level tests meeting market standards, Robot Era remains primarily in the research and development phase, focusing on advancing their language-visual-action model before pursuing widespread commercial applications.

Founded in 2015, Dobot has recently expanded from its established robotic arm business into humanoid robotics with the Dobot Atom. Unveiled in March 2025, this 153cm tall, 62kg humanoid features advanced capabilities including dexterous manipulation and energy-efficient straight-leg walking. With an edge computing power of 1,500 TOPS (7.7 times the industry standard), Atom can perform tasks ranging from breakfast preparation to precision industrial applications. While Dobot has begun accepting preorders at 199,000 yuan ($27,500), mass production isn't scheduled until mid-2025, placing the company in a pre-commercial phase despite its more mature business foundation compared to newer entrants.

PUDU Robotics, established in 2016, began with catering delivery robots and has shipped over 70,000 service robots to more than 60 countries. The company has recently pivoted toward humanoid development, unveiling its first full-sized bipedal humanoid, the PUDU D9, in December 2024. Standing 170cm tall with 42 degrees of freedom and a maximum joint torque of 352 Nm, the D9 builds on PUDU's earlier semi-humanoid D7 and incorporates their DH11 dexterous hand system. While PUDU has announced pre-sales, the D9 remains in late development stages, with the company leveraging its extensive commercial service experience to refine the platform before full-scale deployment. PUDU's "Robot-to-Everything" architecture, introduced in January 2024, aims to create an interconnected ecosystem across specialized, semi-humanoid, and humanoid robots.

Founded in 2023, CASbot has rapidly developed three distinct humanoid platforms tailored to different market segments. Between July and December 2024, the company launched the SA01 bipedal robot for scientific research and education (priced at 3.85 million yuan), the SE01 industrial full-size humanoid (15 million yuan), and the PM01 open-source general-purpose platform (8.8 million yuan). This tiered approach allows CASbot to serve both research institutions and industrial applications while building market presence. Though technically available for purchase, these high-priced units indicate CASbot's current focus on specialized institutional customers rather than mass-market deployment, positioning the company as an emerging player still establishing its technological foundation before pursuing broader commercialization strategies.

LimX Dynamics, established in 2022 and backed by Alibaba as their first investment in the humanoid robotics sector, remains primarily in the research and development phase of humanoid robot technology. The company has demonstrated promising prototypes including the CL-1 humanoid, which has been shown in testing videos performing tasks like stair climbing and package handling, but has not yet commercialized these advanced platforms despite their impressive capabilities. Their only available product is the TRON 1 research platform released in October 2024, which features a modular "Three-In-One" design supporting multiple foot configurations (Point-Foot, Sole, and Wheeled) and is positioned specifically for academic and industrial research applications rather than end-user deployment. Having secured approximately 500 million yuan ($70 million) in Series A funding from investors including China Merchants Venture, NIO Capital, and Lenovo Capital, LimX is continuing development work on general-purpose humanoid robots for future applications in manufacturing, logistics, and service sectors, but remains at the prototype demonstration stage rather than commercial production for their humanoid robotic systems.

The major Chinese technology companies are accelerating their entry into the humanoid robotics market. While internet giants like Alibaba, Baidu, and Tencent have primarily approached the sector through investments and AI large model development (focusing on the "brain" aspect), several companies have committed to developing complete hardware solutions. Based on technical capability, self-developed hardware, product readiness, AI model integration, and commercialization progress, the current industry leaders can be ranked as follows:

Xiaomi > XPeng > Huawei > Tencent > GAC/Chery > ByteDance/Alibaba/Baidu/Meituan

| Company | Baidu | Huawei | Alibaba | Tencent | ByteDance | Meituan | Xiaomi |

| Entry Strategy | Investment + Large Model | Investment + Large Model | Investment + Large Model | Investment + Self-Research | Large Model | Investment | Self-Research |

| AI Model Name | Wenxin (ERNIE) | Pangu + Dengwen | Tongyi Qianwen | Hunyuan, GPTs | GR-2 Embodied Model, Doubao, Yunque | N.A. | N.A. |

| Partner Companies | UBTECH | 16 companies | Youlu Robotics | N.A. | N.A. | N.A. | N.A. |

| Investment Portfolio | Zhiyuan Robotics, Xinghai Tu, etc. | Leju, Dagel, Jimu, etc. | LimX Dynamics, Moonshot AI, MiniMax, Baichuan Intelligence, etc. | Leju Robotics, UBTECH, etc. | Future Robotics, Elephant Robotics, etc. | Yushu Technology, Galaxy General, etc. | Yushu Technology, Dreame Technology, etc. |

| Self-Developed Products | N.A. | N.A. | N.A. | Robotics X Laboratory | N.A. | N.A. | CyberOne |

Unlike most internet companies that focus solely on AI development, Xiaomi has committed to full-stack humanoid robot development. In 2022, Xiaomi unveiled CyberOne, a comprehensive humanoid bionic robot featuring proprietary AI systems. Standing 177cm tall and weighing 52kg, CyberOne incorporates 21 degrees of freedom throughout its body, with each joint capable of responding within 0.5 milliseconds. The robot can recognize 45 human emotional states and distinguish 85 types of environmental sounds. While controlling costs (targeting under 500,000 yuan for mass production), Xiaomi has prioritized integrating CyberOne into its own manufacturing system rather than immediate consumer sales. As of June 2024, Xiaomi relocated its robotics division to its Yizhuang factory in Beijing, where CyberOne is being gradually deployed on production lines.

XPeng entered the robotics sector in 2020 by acquiring "Multi-legged Robot" and establishing "XPeng Robotics." After releasing the bipedal robot PX5 in 2023, XPeng unveiled its advanced humanoid robot "Iron" in November 2024. Iron represents a comprehensive redesign of XPeng's robotic technology, standing 178cm tall and weighing 70kg with 62 active degrees of freedom throughout its body and 15 movable degrees of freedom in its hands. The robot is powered by XPeng's proprietary Turing AI chip, delivering up to 3,000 TOPS of computing power for advanced data processing and learning capabilities. Iron incorporates XPeng's AI Hawk Eye vision system for 720° environmental perception with no blind spots, enabling precise movement and obstacle avoidance through end-to-end large model integration and reinforcement learning algorithms. Currently, Iron is undergoing practical training at XPeng's Guangzhou factory, primarily supporting the production of P7+ vehicle models.

Huawei's robotics journey began in 2017 through research partnerships with the University of Edinburgh and SoftBank. After initial exploration in 2022, Huawei invested 870 million yuan to establish a robotics subsidiary in 2023. On November 15, 2024, the Huawei Global Embodied Intelligence Industry Innovation Center launched in Shenzhen, formalizing partnerships with 16 companies including Leju Robotics, Zhaowei Electromechanical, and others. Huawei's approach focuses on empowering domestic humanoid robot manufacturers through technology and resources, including its Pangu AI model, Bison compiler, and cloud platform infrastructure. Huawei's ecosystem development follows two models: "Huawei Empowerment," where partners develop products using Huawei's technology stack, and "Huawei Smart Choice," a deeper integration model similar to its automotive strategy.

Tencent established its Robotics X laboratory in 2018, adopting its characteristic wait-and-see approach before deeper commitment. In 2023, the lab released the TRX-Hand dexterous manipulator, followed by its first humanoid robot "The Five" in 2024. This four-wheeled robot with tactile skin and advanced hands focuses on recreational and cultural applications but has not yet entered commercial deployment. Tencent's primary strategy involves strategic investments across the robotics ecosystem, including stakes in Leju Robotics (2017), UBTECH (becoming its largest shareholder in 2018), Unitree Technology, and Star Era Robotics. On the AI front, Tencent has invested in seven large model companies including Spectrum AI, Baichuan Intelligence, and Moonshot AI.

In December 2024, GAC unveiled GoMate, its third-generation embodied intelligence robot featuring entirely self-developed core components. GoMate incorporates micro-low-voltage servo drives and integrated joint modules alongside GAC's vision automation algorithms. The robot can switch between quadrupedal and bipedal modes, standing up to 1.75 meters tall with 38 degrees of freedom. GAC plans to begin mass production of these components in 2025, with full robot production targeted for 2026. Initial applications include security inspections, with planned expansion to automotive production lines and after-sales service.

In May 2024, Chery Automobile, in partnership with AI company Aimoga, released the humanoid robot Mornine. The robot features a biomimetic design with a silicone face capable of realistic facial expressions and five-fingered dexterous hands for enhanced manipulation. Chery envisions Mornine evolving through three phases: initially as an information provider, then adding autonomous navigation and manipulation, and finally becoming a comprehensive assistant capable of childcare, elder support, and household management.

The humanoid robotics industry exhibits a clearly structured supply chain divided into three distinct segments. The upstream segment encompasses critical core components including frameless torque motors (from companies like Kollmorgen and Parker), specialized power systems, hollow cup motors (supplied by Faulhaber and Maxon), thermal management systems, precision reducers (from Nabtesco and Harmonic Drive), advanced sensors, specialized AI processors, planetary roller screws, and integrated actuator assemblies. These fundamental components determine the robot's performance capabilities, with Western companies currently dominating this technical space. The midstream segment focuses on humanoid robot manufacturing and integration, with companies like Boston Dynamics, Tesla, 1X Technologies, Agility Robotics, UBTECH, and Xiaomi leading development across global markets. The downstream segment represents application deployment across industrial manufacturing (pioneered by Boston Dynamics and FANUC) and commercial service sectors (represented by iRobot and Aldebaran Robotics). This tripartite structure demonstrates how specialized component technologies flow into robot manufacturing before ultimately reaching end-user applications, with vertical integration emerging as a key competitive advantage for companies operating across multiple segments.

| Supply Chain Level | Category | Key Companies |

| UPSTREAM: Core Components | Frameless Torque Motors | - Kollmorgen - Parker - Aerotech - Buko Corporation |

| Power Batteries | - Tesla - 1X - UBTECH - Dakuo Technology |

|

| Hollow Cup Motors | - Faulhaber - Portescap - Maxon - Allied Motion |

|

| Thermal Management Systems | - Tesla - Nide - Denso - Sanhua Intelligent Controls |

|

| Reducers/Gearboxes | - Nabtesco - Siemens - Kollmorgen - Harmonic Drive |

|

| Sensors | - Bosch - Honeywell - Texas Instruments - Hanwei Technology |

|

| Specialized Chips | - NVIDIA - Intel - Tesla |

|

| Planetary Roller Screws | - Rollvis - Ewellix - Qinchuan Machine Tool |

|

| Actuator Assemblies | - Tesla - 1X - UBTECH |

|

| MIDSTREAM: Humanoid Robot Manufacturing | Robot Manufacturers | - Boston Dynamics - Tesla - 1X Technologies - Agility Robotics - UBTECH - Xiaomi Group - Dakuo Technology |

| DOWNSTREAM: Humanoid Robot Applications | Industrial Manufacturing | - UBTECH - FigureAI |

| Commercial Services | - Agibot |

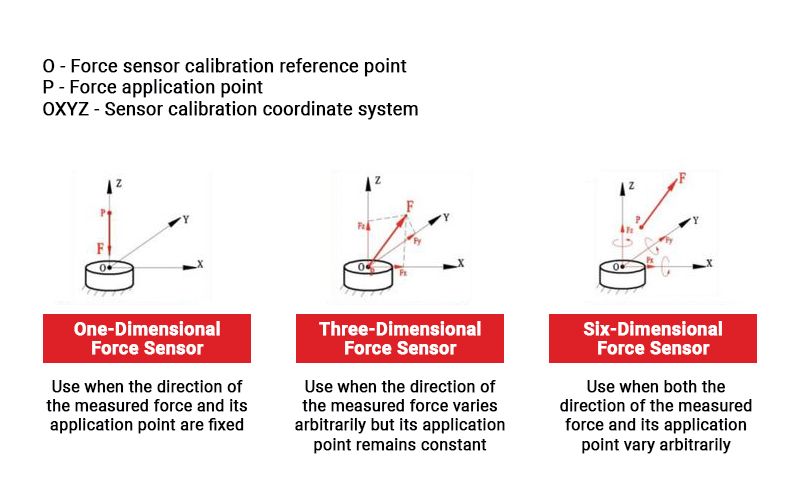

The upstream segment represents the most critical foundation of humanoid robots, comprising essential hardware and software elements. Key hardware components include specialized motors (frameless torque motors and hollow cup motors), precision reducers (harmonic and planetary), planetary roller screws, sophisticated controllers, and various sensors (force/torque, visual, tactile). These physical components work in conjunction with advanced software systems including perception algorithms, motion planning, and artificial intelligence frameworks that enable robotic functionality.

From a long-term perspective, the greatest value within the humanoid robotics industry chain resides in software systems. Companies that master or independently develop advanced motion control algorithms and artificial intelligence capabilities will ultimately control both the technical direction and development pace of humanoid robotics. These software-focused enterprises will become the "central nervous system" and "brain" of the industry, often positioning themselves as leaders in midstream robot manufacturing as well.

In the current market, core hardware components such as sensors, reducers, motors, and screws constitute a significant proportion of humanoid robot value, offering substantial growth opportunities. China's robust industrial foundation and comprehensive manufacturing ecosystem provide an exceptional environment for developing these critical humanoid robot components, representing enormous potential for China’s production and innovation in the field.

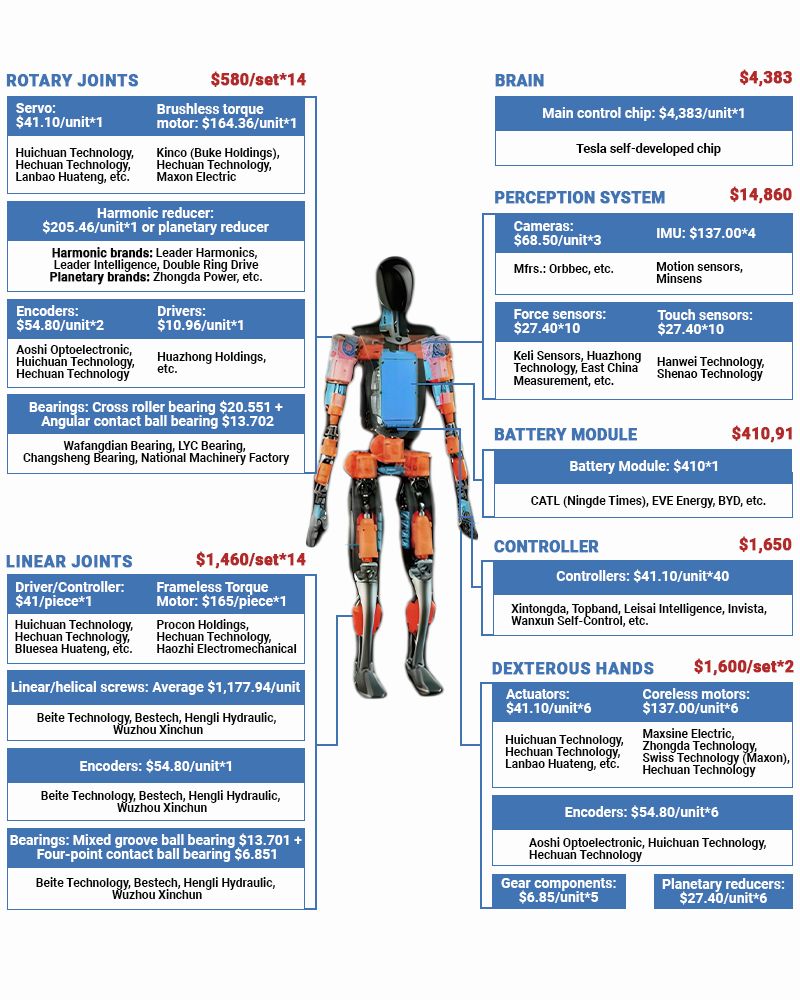

To illustrate these principles, we examine Tesla's Optimus humanoid robot as a case study for component integration and value distribution.

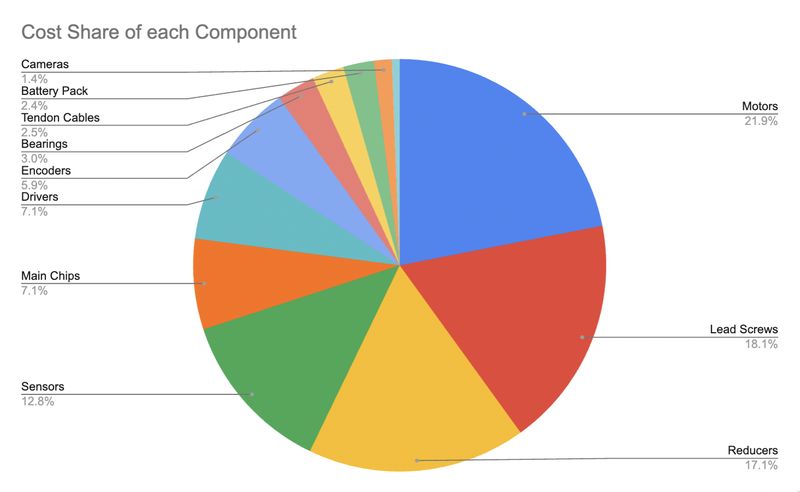

The following analysis breaks down the value allocation of major components based on an estimated $20,000 production cost target.

From a technical barrier perspective, the components rank in descending order of complexity: planetary roller screws > six-dimensional torque sensors > harmonic reducers > hollow cup motors > frameless torque motors.

Let's examine each category.

Humanoid robots utilize two primary motor types: frameless torque motors for joint articulation and hollow cup motors for dexterous hand movements. These specialized motors differ significantly from conventional electric motors, requiring precise control systems and compact designs to enable human-like movement while maintaining adequate power output.

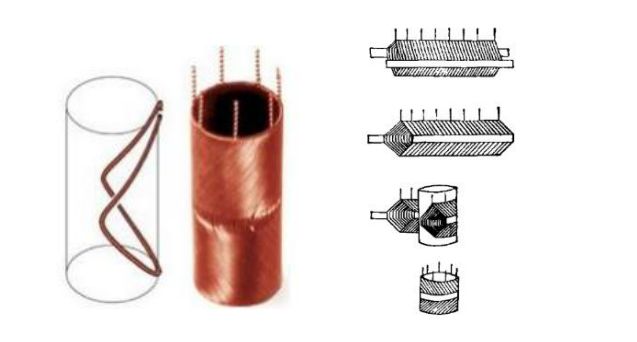

Frameless torque motors represent a specialized category of permanent magnet brushless synchronous motors distinguished by their minimal design. Unlike conventional motors, they lack a shaft, bearings, housing, feedback mechanisms, or end caps, consisting of only two essential components: a stator and a rotor. The rotor (internal component) features a rotating steel circular assembly embedded with permanent magnets and mounts directly onto the machine shaft. The stator (external component) consists of steel elements encircled by copper windings that generate electromagnetic force when energized, and fits tightly within the machine casing.

As a specialized type of servo motor, frameless torque motors offer several critical advantages for humanoid robotics applications. Their lightweight, compact design facilitates seamless integration into robotic joints while simplifying maintenance procedures. These motors deliver faster response to movement commands and greater energy efficiency compared to conventional alternatives. Most importantly, they provide superior torque at low and medium speeds—precisely matching the requirements of humanoid robot linear and rotary joints, which typically operate at lower speeds while demanding high torque output.

The frameless torque motor market reached approximately 669 million yuan in 2022, representing a relatively specialized segment with moderate technical barriers. These barriers primarily involve magnetic circuit design, manufacturing process refinement, and the challenge of generating high power output from low-voltage power supplies. Leading Western suppliers include Kollmorgen, TQ Robodrive, Nidec, and Parker, which have historically dominated the high-performance segment. However, Chinese manufacturers have made significant competitive inroads, with companies like Buko (whose third-generation products now rival international leaders), Weichuang Electric, Wochuan Technology, Hetai Technology, and Danu Motors emerging as domestic champions in this increasingly important component category.

Hollow cup motors feature a distinctive design incorporating a coreless rotor and cup winding structure, fundamentally differentiating them from conventional motors. This specialized architecture enables extremely compact dimensions, typically under 40mm in diameter, while delivering exceptional performance characteristics. The coreless design eliminates iron losses and cogging torque, resulting in smooth motion even at very low speeds. These motors provide substantial advantages for robotic applications, including minimal size and weight, rapid acceleration response (typically 1-3 milliseconds), and superior energy conversion efficiency approaching 90% in optimal conditions.

The manufacturing of high-quality hollow cup motors presents three significant technical challenges: sophisticated coil design requiring advanced electromagnetic modeling, precision coil winding demanding tolerances measured in micrometers, and specialized automation equipment for consistent production. These technical hurdles have limited market entry for many manufacturers. Due to their exceptional precision and compact form factor, hollow cup motors are ideally suited for applications requiring both space constraints and high performance, such as aerospace instrumentation, CNC machine tool components, and—most relevant to humanoid robotics—dexterous robotic hands where multiple motors must fit within a human-sized palm while providing precise finger articulation.

China's hollow cup motor market reached approximately 1.138 billion yuan in 2023, characterized by high concentration with dominant market share held by international manufacturers. Western companies controlled approximately 88% of this specialized market in 2023, with Swiss manufacturer Maxon Motor, German company Faulhaber, and Swiss-American Portescap (a Portescap Corporation subsidiary) maintaining leadership positions due to their long-established expertise and patent portfolios. Chinese manufacturers including Mingzhi Motor, Zhaowei Electromechanical, Weichuang Electric, Topband, and Leisai Intelligence have begun challenging this dominance through strategic investments in advanced manufacturing capabilities and proprietary designs specifically tailored for emerging applications in robotics and automation.

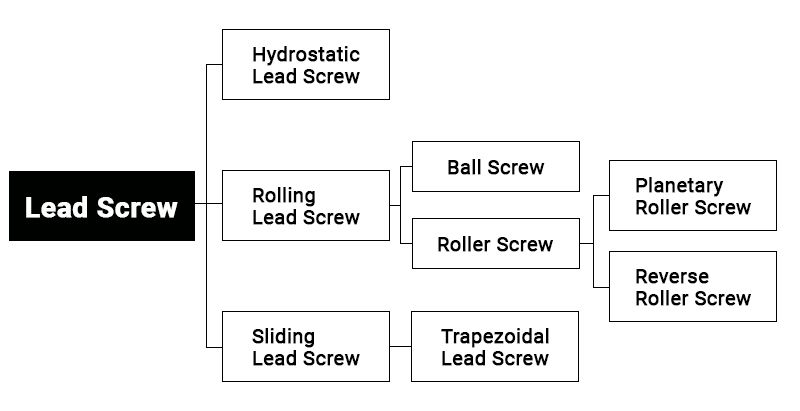

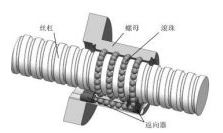

Screws serve as essential mechanical transmission devices in humanoid robots, converting rotary motion from motors into precise linear movement. Their fundamental structure consists of a screw shaft with helical grooves engaging with a movable nut that travels along the shaft axis during rotation, enabling power transmission and position control. Screws are classified by friction characteristics into sliding screws, rolling screws, and hydrostatic screws. Within the rolling screw category, two primary types are used in robotics: ball screws and planetary roller screws. Ball screws offer low friction, high transmission efficiency, and precision positioning, with domestic production exceeding 60% of market demand. Planetary roller screws provide superior performance with higher load capacity, exceptional impact resistance, compact dimensions, faster operation speeds (up to 6,000 RPS compared to 3,000-5,000 RPS for ball screws), reduced noise, and significantly longer service life—often exceeding ball screws by a factor of ten—with transmission efficiency reaching 98%.

| Category | Planetary Roller Screw | Ball Screw |

| Illustration |  |

|

| Rolling element | Roller | Ball |

| Circulation mode of elements | Rollers orbit around the screw shaft axis in planetary motion | Circulation via a return mechanism to achieve rolling |

| Load condition of elements | Large contact area; all rollers share load simultaneously, with no cyclic alternating force | Small contact area; balls load in sequence, producing cyclic alternating stress |

| Centrifugal force on elements | Prevented by the planetary mechanism | Can become significant at high operating speeds |

| Pure rolling ratio | Very high | Relatively high |

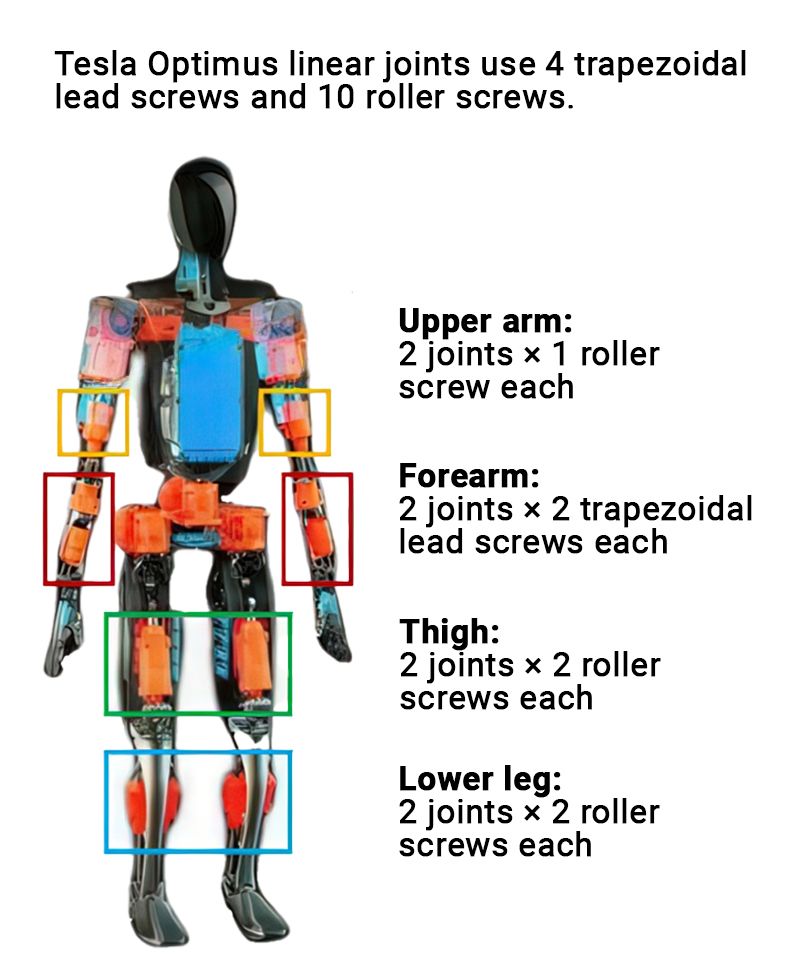

Planetary roller screws represent one of the most technically demanding components in humanoid robots, creating a significant barrier to entry for manufacturers. The challenges include achieving micron-level precision (P1 grade), ensuring exceptional material purity, developing proprietary formulations, and mastering complex heat treatment processes that can involve 10-20 specialized manufacturing techniques. These components were traditionally used in precision machine tools, aerospace systems, and automotive applications before being adapted for humanoid robotics. In Tesla's Optimus robot design, screws constitute 23% of the linear joint assembly, with trapezoidal screws employed in lower-load applications like forearm articulation, while planetary roller screws handle the substantial mechanical stresses in major load-bearing segments including upper arms, thighs, and calves. The strategic importance of these components has prompted companies like BEST, Qinchuan Machine Tool, and others to accelerate development efforts to achieve domestic production capabilities.

The global ball screw market reached approximately $1.96 billion in 2023, with China's domestic market valued at 2.05 billion RMB. The more specialized planetary roller screw market remains dominated by established Western manufacturers including Ewellix (formerly SKF), Rollvis, GSA, Bosch Rexroth, and Creative Motion Control (CMC), who have developed proprietary technologies over decades. Chinese manufacturers have made significant inroads in recent years, with leading companies including Beitech, BEST, Hengli Hydraulic, Wuzhou Xinchun, Shuanglin, Dingzhi Technology, Rifa Precision Machinery, and Huachen Equipment developing competitive alternatives. This component category represents the most significant "choke point" in China's humanoid robotics supply chain, with continuing dependence on imported high-precision planetary roller screws for the most demanding applications, though domestic capabilities are advancing rapidly as manufacturers gain experience in high-precision manufacturing techniques.

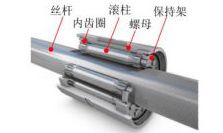

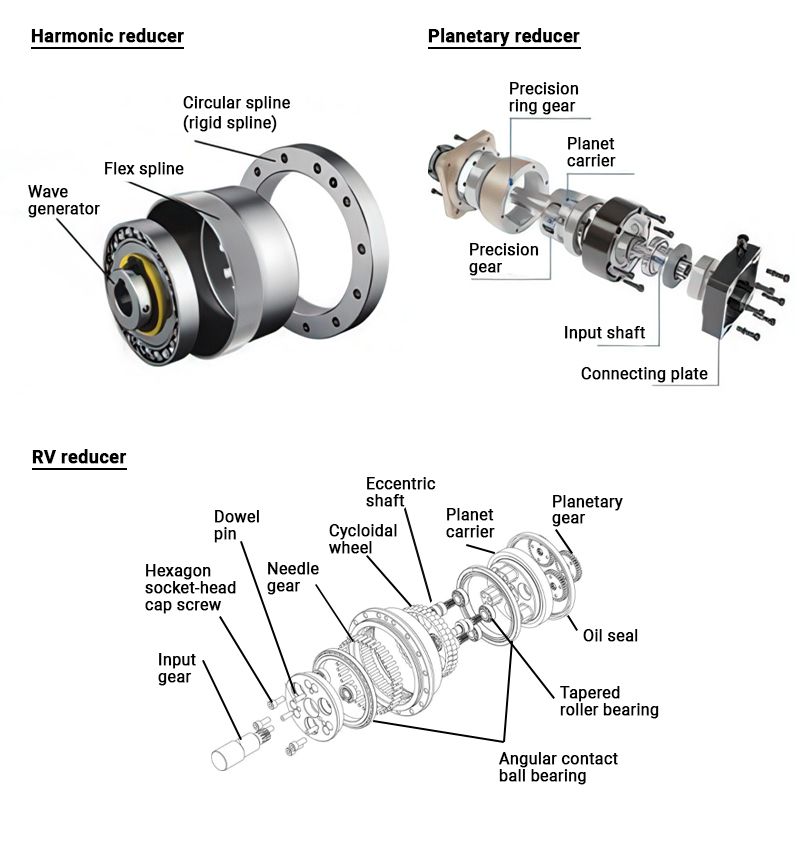

Reducers function as core mechanical components within humanoid robots, serving as the crucial interface between power sources and actuator mechanisms. Their primary functions include modifying rotational speed, transferring torque efficiently, and enhancing control precision throughout the robotic system. For humanoid robotics applications, three primary reducer categories are employed: harmonic reducers, RV (Rotary Vector) reducers, and planetary reducers. Each type offers distinct performance characteristics suited to different applications within the robot's architecture. Harmonic reducers, characterized by their compact profile and high reduction ratios (typically 50:1 to 160:1), deliver exceptional precision and are primarily deployed in rotary joints throughout the robot's body. Planetary reducers feature smaller dimensions, lighter weight, and superior transmission efficiency, but with lower precision than harmonic systems, making them ideal for hand joints or body joints with less stringent accuracy requirements. RV reducers, while offering excellent performance, have limited application in humanoid robots due to their larger size and weight.

There are three main reducer types: harmonic reducers, RV reducers and planetary reducers. The main features are listed below.

Figure XX: Harmonic reducer (left), RV reducer (center), planetary reducer (right)

| Performance Metric | Harmonic Drive | RV Reducer | Precision Planetary Reducer |

| Composition | Flexible spline, rigid spline, wave generator, etc. | Planetary reducer front stage + cycloidal pin-wheel (trochoidal) reducer rear stage. | Planet gears, sun gear, ring gear, etc. |

| Working Principle | The prime mover drives the wave generator, which deforms the flexible spline to mesh with the rigid spline, causing the flexible spline to rotate slowly opposite the wave generator's motion. | Input power is transmitted via the input shaft to the planetary gears for the first-stage reduction; the eccentric crank then drives the cycloidal disc in an eccentric motion, whose pins engage the housing, realizing the second-stage reduction. | The prime mover drives the sun gear; the sun gear meshes with the planet gears, causing them to spin. As the planet gears roll inside the ring gear, they orbit the sun gear, driving the planet carrier-connected to the output shaft-to rotate. |

| Size | Small | Large | Small |

| Transmission Efficiency | > 70% | > 80% | > 95% |

| Transmission Accuracy (arc ") | ≤ 60 | ≤ 60 | ≤ 180 |

| Output Torque Range (N·m) | 6.6–921 | 101–6135 | 40–1200 |

| Transmission Ratio Range | 30–160 | 30–192.4 | 3–512 |

| Torsional Stiffness (N·m/arc min) | 1.34–50.09 | 20–1176 | 10–370 |

| Service Life (h) | > 8000 | > 6000 | > 20000 |

| Typical Applications | Lightweight load zones (e.g., forearm, wrist, hand) | Heavy-load zones (e.g., base, upper arm, shoulder) | Lower limbs, hip joints, etc. |

| Unit Price (USD) | 137–685 | 685–959 | 164–1781 |

Comparison of the differences between the three major speed reducers

The global market for precision reducers demonstrates clear regional leadership patterns. According to industry data, the 2023 global market sizes for harmonic, RV, and precision planetary reducers each remained below 10 billion yuan. China's domestic market reached 2.43 billion yuan for harmonic reducers, 5.022 billion yuan for RV reducers, and 3.536 billion yuan for precision planetary reducers.